Securities Exchange Act of 1934

(Amendment No.)

[ ]

| [X] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| (4) | Proposed maximum aggregate value of transaction: | ||

| (5) | Total fee paid: | ||

| [ ] | Fee paid previously with preliminary materials. | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | ||

| (3) | Filing Party: | ||

| (4) | Date Filed: | ||

I am writing to you on an important matter relating to

Liquidation.

C will not affect the value of your Contract.

A Special Meeting of Shareholders (the “Meeting”) of Series E and Series P has been scheduled for [October 10], 2014 to vote on this proposal.

If you are an insurance product ownerconnection with an investment in Series E and/or Series P as of the close of business on [August 22, 2014], you are entitled to vote at the Meeting and any adjournment of the Meeting, even if you no longer own an insurance product. Pursuant to these materials, you are being asked to approve the proposal for the Series, as described above.

your Contract.

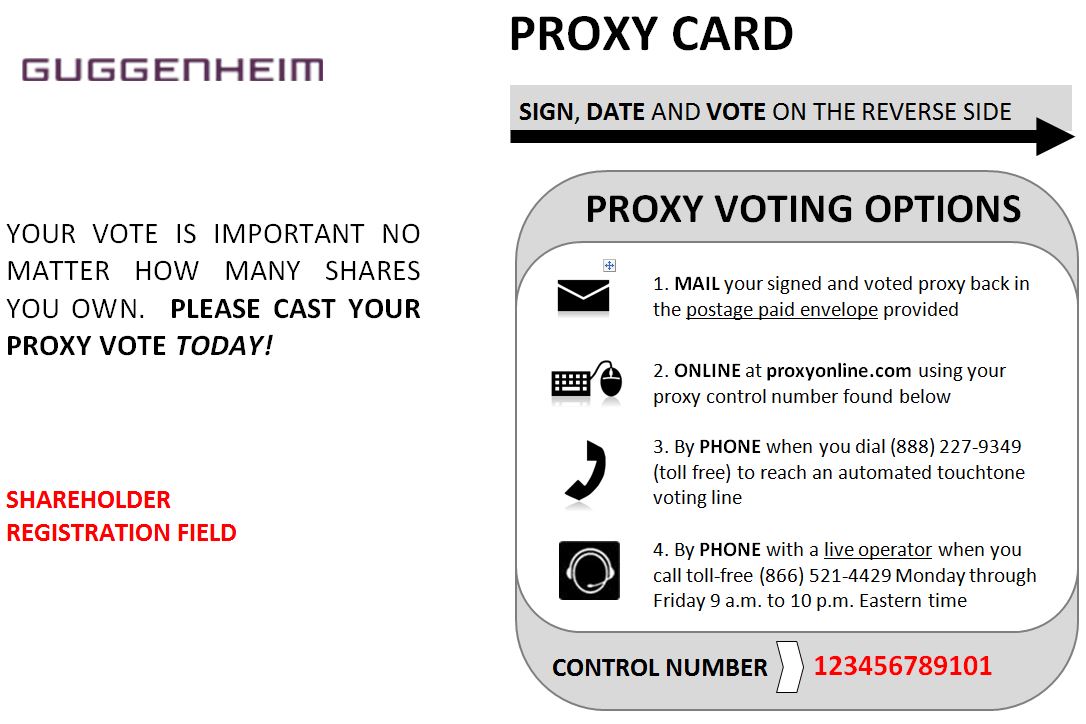

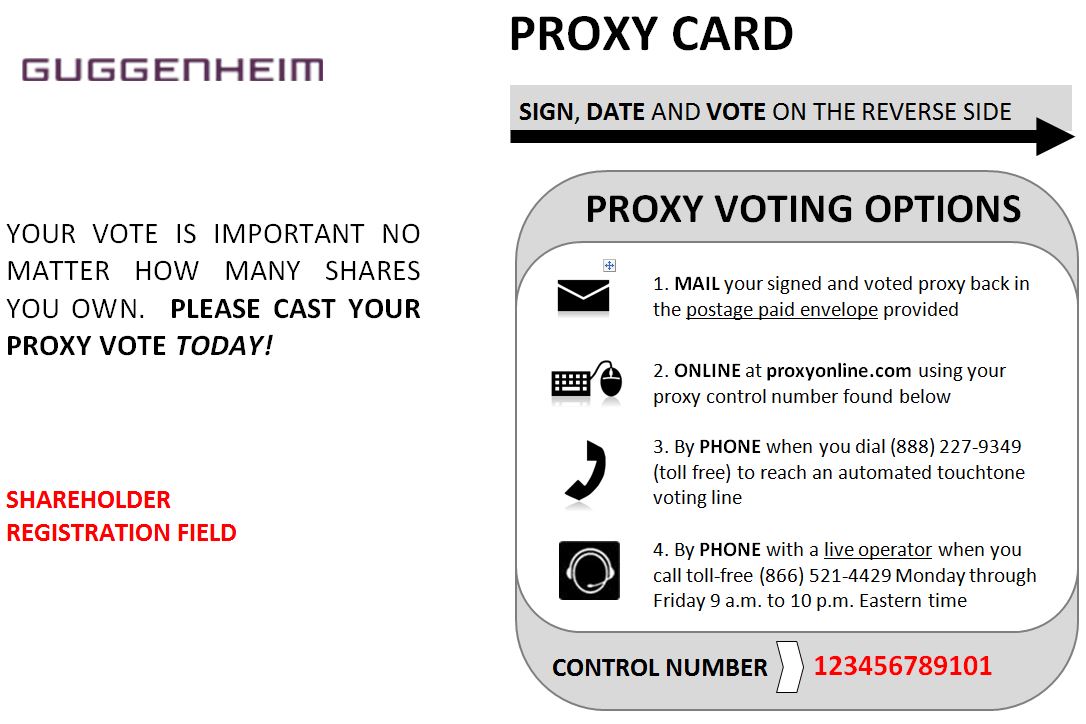

| • | By mail with the enclosed voting instruction card – be sure to sign, date and return it in the enclosed postage-paid envelope, | ||

| • | On the Internet through the website listed in the proxy voting instructions, | ||

| • | By telephone using the toll-free number listed in the proxy voting instructions, or | ||

| • | In person at the Meeting. | ||

you take the time to carefully consider and vote on the important proposals.Liquidation Proposal. Please read the enclosed information carefully before voting. If you have any questions, please call [ ], the Series’AST Fund Solutions, LLC, Series C’s proxy solicitor, at [ ].

1-866-521-4429.

| Sincerely, |

|

PROMPT EXECUTION AND RETURN OF THE ENCLOSED VOTING INSTRUCTION CARD IS REQUESTED. A SELF-ADDRESSED, POSTAGE-PAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE, ALONG WITH INSTRUCTIONS ON HOW TO VOTE OVER THE INTERNET OR BY TELEPHONE SHOULD YOU PREFER TO VOTE BY ONE OF THOSE METHODS.

| Q. | Why am I receiving this Proxy Statement? |

| A. | You are receiving these proxy materials — a booklet that includes the Proxy Statement and your voting instruction card — because you are among those who own a variable annuity contract or a variable life insurance policy (each, a “Contract”) issued by Security Benefit Life Insurance Company or its affiliates (each, a “Contract Owner”). As a Contract Owner, you have the right to For ease of reference, throughout this Questions and Answers section, |

The Board of Trustees (“Board”) of the Trust is recommending that the shareholders of the Series approve a Distribution and Shareholder Services Plan (the “Distribution Plan”) pursuant to Rule 12b-1 of the Investment Company Act of 1940 (the “1940 Act”). If the Distribution Plan is approved by shareholders, the Series would each pay a new separate fee for distribution and shareholder services. However, in order to offset this new fee, the Board and Security Investors, LLC (also known as “Guggenheim Investments”), the Series’ investment adviser (the “Investment Manager”), have agreed to contractually reduce the investment advisory fee charged by the Investment Manager to both Series and, with respect to Series P, implement an additional expense limitation agreement. Therefore, the implementation of the Distribution Plan is not expected to lead to higher total fees or expenses for Series E and, with respect to Series P, for so long as the expense limitation agreement is in effect.

| Q. | Why am I being asked to vote? |

| A. | You are, or were, as of |

- i -

| Why is the Board recommending approval of the |

| A. | As described in the enclosed Proxy Statement, the Board |

- ii -

Voting

| appropriate. After careful consideration, the Board unanimously recommends that you vote “FOR” the |

| Q. | What are the tax implications of the Plan of Liquidation? |

| A. | The liquidation and transfer of contract value in connection with the Liquidation Proposal is |

| Q. | Who is asking for my vote? |

| A. | Your vote is being solicited by the |

| Q. | What vote is required to approve the Liquidation Proposal? |

| A. | |

| Q. | Will my vote make a difference? |

| A. | Yes! Your vote is needed to ensure that the Liquidation Proposal can be acted upon. We encourage all shareholders to participate in the governance of |

| Q. | If I am a small investor, why should I bother to vote? |

| A. | You should vote becauseevery vote is important. |

- iii -

| its affiliates, whose separate |

| Q. | How will my vote be counted? |

| A. | As |

| Q. | How do I place my vote? |

| A. | You may Proxies may be revoked prior to the Meeting by timely executing and submitting a revised proxy (following the methods noted above), by giving written notice of revocation to the Secretary of the Trust prior to the Meeting, or by voting in person at the Meeting. |

| Q. | Whom do I call if I have questions? |

| A. | We will be happy to answer your questions about this proxy solicitation. If you have questions, please call |

Proxies may be revoked prior to the Meeting by timely executing and submitting a revised proxy (following the methods noted above), by giving written notice of revocation to the Series prior to the Meeting, or by voting in person at the Meeting.

- iv -

Suite 600

[1-800-820-0888]

2016

| 1. | ||

| To Approve | ||

| 2. | To Transact Such Other Business as May Properly Come Before the Meeting | |

After careful consideration,

Variableenclosed Proxy Statement because you are among those who own a variable annuity contract andor a variable life insurance policy (“insurance product”(each, a “Contract”) ownersissued by Security Benefit Life Insurance Company or its affiliates (each, a “Contract Owner”). As a Contract Owner, you have the right to instruct SBL on how shares of Series C attributable to your Contract should be voted at the Meeting. For ease of reference, throughout this Notice, Contract Owners that have allocated a portion of their contract value to Series C are also referred to as “shareholders” of Series C. In addition, Security Benefit Life Insurance Company and/or its affiliates, as the context requires, are referred to as "SBL."

own (or owned).

- v -

- vi -

| ||||

| ||||

- vii -

APPENDICES

- viii -

Suite 600

APRIL [15], 2016

| 1. | To Approve | |||||

2. | To Transact Such Other Business as May Properly Come Before the Meeting | |||||

The Board has determined that the use of this Proxy Statement for the Meeting is in the best interests of each Series and its shareholders in light of the similar matters being considered and voted on by the shareholders of the other Series.

You are entitled to vote at the Meeting of each Series of which you are2016.

Guggenheim Variable Funds Trust is soliciting voting instructions from insurance product owners invested in eachSeries C directly but rather by virtue of Series E and Series P in connection with the Proposal. As such and for ease of reference, throughout this Proxy Statement, insurance product owners may be referred to as “shareholders”your ownership of a Series.

Contract. As a result, you have a beneficial interest in Series C through the Contract(s) that you own (or owned).

1-866-521-4429.

FOR THE MEETING TO BE HELD ON [OCTOBER 10]APRIL [15], 2014

2016

- 2 -

The Board has approved the adoption of a new Distribution and Shareholder Services Plan (the “Distribution Plan”) pursuant to Rule 12b-1 under the U.S. Investment Company Act of 1940 (the “1940 Act”), for Series E and Series P, subject to shareholder approval. Currently, the Series do not have a plan adopted pursuant to Rule 12b-1 under the 1940 Act. The Distribution Plan would allow each of Series E and Series P to pay up to 0.25% of its average daily net assets to Guggenheim Funds Distributors, LLC (“Guggenheim Funds Distributors”), the Series’ principal underwriter.

The Distribution Plan was approved by the Trust’s Board of Trustees (the “Board”), including a majority of Trustees who are not “interested persons,” as defined in the 1940 Act, and who have no direct or indirect financial interest in the operation of the Distribution Plan or any agreement relating to it (“Independent Trustees”), at an in person meeting duly called and held on

August 19-20, 2014. The Distribution Plan will become effective with respect to the Series upon approval by the Series shareholders.

The Board recommends the approval of the Distribution Plan after finding that there is a reasonable likelihood the adoption of the Distribution Plan is reasonably likely to benefit the Series and their shareholders for several reasons. Based on the recommendation by Security Investors, LLC (also known as “Guggenheim Investments”), the Series’ investment adviser (the “Investment Manager”), the Board believes the Distribution Plan would assist the Series in seeking additional distribution channels in the insurance products industry, which, if successful, would result in increased fund assets, which in turn could result in economies of scale. The Board noted the prevalence of similar plans in the insurance products industry and believes that the Distribution Plan is a reasonable method for compensating insurance companies for distribution, shareholder and administrative services.

Finally, the Board noted that the implementation of the Distribution Plan is not expected to lead to higher total contractual fees or expenses for Series E and Series P. In particular, contingent upon shareholder approval and adoption of the Distribution Plan for the Series, the Board and the Investment Manager have agreed to reduce the contractual management fee charged by the Investment Manager to the Series. The shareholders of Series E and Series P currently pay a management fee of 0.75% (as a percentage of average daily net assets). If the Distribution Plan is adopted, this fee will be reduced to 0.50% for Series E and 0.60% for Series P. In addition, the Board and the Investment Manager have also agreed to implement an additional expense limitation agreement for Series P. Under the expense limitation agreement, the Investment Manager would contractually agree through May 1, 2017 to waive fees and/or reimburse Series expenses to the extent necessary to limit the ordinary operating expenses (exclusive of brokerage costs, dividends on securities sold short, acquired fund fees and expenses, interest, taxes, litigation, indemnification, and extraordinary expenses) (“Operating Expenses”) of Series P to the annual percentage of 1.07% of average daily net assets of the Series, equivalent to the Operating Expenses of the Series as of December 31, 2013. The agreement will expire when it reaches its termination or when the investment adviser ceases to serve as such (subject to recoupment rights). Therefore, the implementation of the Distribution Plan is not expected to lead to higher total contractual fees or expenses for Series E and Series P (with respect to Series P, until May 1, 2017). After that date, if the Board and the Investment Manager do not agree to the continuation of the expense limitation agreement, the overall fees charged to Series P would be higher.

- 3 -

THE BOARD, INCLUDING THE INDEPENDENT TRUSTEES,

UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE

PROPOSAL. UNMARKED, PROPERLY SIGNED AND DATED PROXIES WILL BE

SO VOTED.

- 4 -

THE PROPOSAL: THE APPROVAL OF THE DISTRIBUTION AND SHAREHOLDER

SERVICES PLAN

Introduction

The Board has approved the adoption of a Distribution Plan pursuant to Rule 12b-1 under the 1940 Act for Series E and Series P, subject to shareholder approval. The Distribution Plan would allow each of Series E and Series P to pay up to 0.25% of its average daily net assets to Guggenheim Funds Distributors for providing distribution, shareholder and administrative services. The Distribution Plan was approved by the Trust’s Board, including a majority of the Independent Trustees, at an in person meeting duly called and held on August 19-20, 2014. The Distribution Plan will become effective with respect to the Series upon approval by the Series’ shareholders.

The Board recommends that the shareholders approve the Distribution Plan, a form of which is attached as Exhibit A.

Description of the Distribution Plan

The followingbrief summary of the Distributionprincipal terms of the Plan of Liquidation and is qualified in its entirety by reference to the formPlan of the Distribution Plan attached to this Proxy Statement as Exhibit A.

The Distribution Plan is substantially the same as the current distribution and shareholder services plan in place for two other series of the Trust, Series F (Floating Rate Strategies Series) and Series M (Macro Opportunities Series). The Distribution Plan is also comparable to the distribution and shareholder services plan in place for certain classes of Guggenheim Total Return Bond Fund and Guggenheim High Yield Fund, both series of Guggenheim Funds Trust, which are retail mutual funds that have investment objectives, strategies and risks that are similar to those of Series E and Series P, respectively (the “Retail Series”).

Payments

The proposed Distribution Plan authorizes payments from assets attributable to shares of the Series forLiquidation, a variety of services with respect to the Series’ shares, including any type of activity that is primarily intended to result in the sale of the shares, as well as related shareholder and administrative services. The Distribution Plan relies on the provisions of Rule 12b-1 under the 1940 Act, to the extent applicable, to make these payments.

The Distribution Plan provides that Shares of each Series may pay to Guggenheim Funds Distributors, the Series’ principal underwriter, as compensation for providing distribution, shareholder and administrative services for the payment of fees accrued under the Distribution Plan at the rate of 0.25% (as a percentage of average daily net assets of the respective Series).

- 5 -

Services for which payments may be used

The payments made by the Series pursuant to the Distribution Plan may be used by Guggenheim Funds Distributors for purposes, including: (i) compensation to employees of Guggenheim Funds Distributors; (ii) compensation to Guggenheim Funds Distributors and other broker-dealers that engage in or support the distribution of shares or variable contracts whose proceeds are invested in shares of the Series; (iii) expenses of Guggenheim Funds Distributors and such other broker-dealers and entities, including overhead and telephone and other communication expenses; (iv) printing of prospectuses, statements of additional information, and reports for other than existing shareholders; (v) preparation and distribution of sales literature and advertising materials; (vi) administering periodic investment and periodic withdrawal programs; (vii) researching and providing historical account activity information for shareholders requesting it; (viii) preparing and mailing account and confirmation statements to account holders; (ix) preparing and mailing tax forms to account holders; (x) serving as custodian to retirement plans investing in Shares; (xi) dealing appropriately with abandoned accounts; (xii) collating and reporting the number of Shares attributable to each state for blue sky registration and reporting purposes; (xiii) identifying and reporting transactions exempt from blue sky registration requirements; and (xiv) providing and maintaining ongoing shareholder services for the duration of the shareholders’ investment in Shares of each Series, which may include updates on performance, total return, other related statistical information, and a continual analysis of the suitability of the investment in Shares of each Series.

Under the Distribution Plan, expenditures by Guggenheim Funds Distributors may also be for providing services to life insurance companies that issue variable annuity contracts and/or variable life insurance policies (“Variable Contracts”), their affiliates, or current and prospective owners of Variable Contracts including the following: (i) teleservicing support in connection with the Series; (ii) delivery and responding to inquires respecting the Series’ Prospectus and/or Statement of Additional Information, reports, notices, proxies and proxy statements and other information respecting the Series (but not including services paid for by the Trust such as printing and mailing); (iii) facilitation of the tabulation of Variable Contract owners’ votes in the event of a meeting of shareholders; (iv) the conveyance of information to the Trust, or its transfer agent as may be reasonably requested; (v) provision of support services including providing information about the Trust and the Series and answering questions concerning the Trust and the Series, including questions respecting Variable Contract owners’ interests in the Series; (vi) provision and administration of Variable Contract features for the benefit of Variable Contract owners participating in the Series including fund transfers, dollar cost averaging, asset allocation, portfolio rebalancing, earnings sweep, and pre-authorized deposits and withdrawals; and (vii) provision of other services deemed appropriate by Guggenheim Funds Distributors from time to time.

The foregoing discussion is qualified by reference to the actual provisions of the Distribution Plan, a copyform of which is attached as Appendix A. The Plan of Liquidation will become effective with respect to Series C upon approval by shareholders, with the liquidation of Series C to occur on or about April [29], 2016 (the “Liquidation Date”).

TerminationStatement; (ii) that the management of money market funds is not a core business of Security Investors, LLC or its affiliates; (iii) that, after evaluating other alternatives to liquidation, Security Investors, LLC recommended that the Board approve the liquidation of Series C; and Board reporting

The Distribution Plan provides(iv) that it will continue in effect from yearthe liquidation (and contract value transfers) should not be a taxable event to year, provided that its

- 6 -

continuance is approved at least annually by a vote of a majorityshareholders.

In addition, the Distribution Plan may be terminatedLiquidation is solicited to meet applicable regulatory requirements with respect to the transfer of contract values in Series C to Invesco V.I. Money Market Fund (Series II).

Advisory Fee Reduction and the Implementation ofdefault investment option is an Expense Limitation Agreement for

Series P

Contingent upon shareholder approval and adoption of the Distribution Plan for the Series,insurance company matter. Thus, neither the Board, andSeries C nor its investment manager had any role in selecting the Investment Manager have agreed to reduceInvesco V.I. Money Market Fund (Series II) as the contractual management fee payable by the Series to the Investment Manager. The shareholders of Series E and Series P currently pay a management fee of 0.75% (as a percentage of average daily net assets). If the Distribution Plan is adopted, this fee will be reduced to 0.50% for Series E and 0.60% for Series P. In addition, if the Distribution Plan is adopted, the Investment Manager will institute an additional expense limitation agreement for Series P to limit total ordinary operating expenses to 1.07% through May 1, 2017, such that overall fees will not increase. Under the expense limitation agreement, the Investment Manager would contractually agree through May 1, 2017 to waive fees and/or reimburse Series expenses to the extent necessary to limit the Operating Expenses of Series P to the annual percentage of 1.07% of average daily net assets of the Series, equivalent to the Operating Expenses of the Series as of December 31, 2013. Therefore, Series E’s contractual fees are not expected to increasedefault investment option. SBL may realize economic benefits as a result of the adoptionliquidation and transfer of the Distribution Plan, and Series P’s total fees and expenses are not expected to increase so long as the expense limitation agreement is in place.

Current and Pro Forma Fees

The table below compares the Series’ operating expenses for the fiscal year ended December 31, 2013contract values to the Series’ hypothetical operating expenses forInvesco V.I. Money Market Fund, which has adopted a plan of distribution under Rule 12b-1. The plan allows the same period if the proposed distribution and shareholder service fee under the Distribution Plan had been in place for the entire fiscal year. The hypothetical “pro forma” fees assume (i) the implementation of the distribution and shareholder services fees under this Proposal; (ii) proposed decrease advisory fee for both Series; and the (iii) proposed additional expense limitation agreement for Series P.

- 7 -

Series E

| Current | Pro Forma | |||||||||||||||

Management Fees | 0.75 | % | 0.50 | % | ||||||||||||

Distribution and Service (12b-1) Fees | 0.00 | % | 0.25 | % | ||||||||||||

Other Expenses | 0.32 | % | 0.32 | % | ||||||||||||

Extraordinary Expense | 0.06 | % | 0.06 | % | ||||||||||||

Remaining Other Expenses | 0.26 | % | 0.26 | % | ||||||||||||

|

|

|

| |||||||||||||

Total Annual Fund Operating Expenses | 1.07 | % | 1.07 | % | ||||||||||||

Fee Waiver (and/or Expense Reimbursement)1 | 0.20 | % | 0.20 | % | ||||||||||||

|

|

|

| |||||||||||||

Total Annual Fund Operating Expenses after Fee Waiver (and/or Expense Reimbursement) | 0.87 | % | 0.87 | % | ||||||||||||

|

|

|

| |||||||||||||

Series P

| Current | Pro Forma | |||||||||||

Management Fees | 0.75 | % | 0.60 | % | ||||||||

Distribution and Service (12b-1) Fees | 0.00 | % | 0.25 | % | ||||||||

Other Expenses | 0.32 | % | 0.32 | % | ||||||||

|

|

|

| |||||||||

Total Annual Fund Operating Expenses | 1.07 | % | 1.17 | % | ||||||||

Fee Waiver (and/or expense reimbursement)1 | N/A | 0.10 | % | |||||||||

|

|

|

| |||||||||

Total Annual Fund Operating Expenses after Fee Waiver (and/or Expense Reimbursement) | N/A | 1.07 | % | |||||||||

|

|

|

| |||||||||

- 8 -

EXAMPLES

These Examples assume that you invest $10,000 in a Series for the time periods indicated and that your investment has a 5% return each year. The tables first show an expense example for the Series assuming that the Series’ total operating expenses remain at current levels. The table then shows the effect on expenses if the proposed Distribution Plan is approved and implemented. The expense ratios and examples below do not reflect the fees and expenses of any variable insurance contract that may use the Trust as its underlying investment medium. If such fees and expenses had been reflected, the expense ratios and shareholder expenses figures would be higher. You would pay the following expenses if you redeemed your shares at the end of each period. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

Series E

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

Current | $ | 89 | $ | 320 | $ | 571 | $ | 1,288 | ||||||||

Pro Forma | $ | 89 | $ | 320 | $ | 571 | $ | 1,288 | ||||||||

Series P

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

Current | $ | 109 | $ | 340 | $ | 590 | $ | 1,306 | ||||||||

Pro Forma | $ | 109 | $ | 362 | $ | 634 | $ | 1,411 | ||||||||

The above Examples reflect applicable contractual fee waiver/expense reimbursement arrangements for the duration of the arrangements only.

The purpose of the table and the example above is to assist shareholders in understanding the effect of the adoption of the proposed Distribution Plan on the various costs and expenses of investing in shares of the Series. The example is for comparison only and does not represent the Series’ actual or future expenses or return. The example should not be considered a representation of future expenses.

- 9 -

Evaluation by the Board of Trustees

[The Investment Manager and Guggenheim Funds Distributors wish to promote the Series to a broader investor base in order to increase the size of the Series. The Investment Manager and Guggenheim Funds Distributors believe that, for their promotional efforts to be successful, the Series need to offer competitive compensation to insurance companies and their affiliates that offer the Series as investment options in variable contracts and to other intermediaries that sell variable insurance products or service variable insurance contract owners. The Investment Manager also believes that the Distribution Plan would permit these competitive compensation arrangements.

The Board has considered the Proposal. It concluded that the Distribution Plan is reasonably likely to benefit each Series and its shareholders and is in the best interests of each Series and its shareholders. The Independent Trustees were assisted by independent counsel in making this determination. Accordingly, the Trustees, including the Independent Trustees, have unanimously approved the Distribution Plan. In reaching its conclusion, the Board considered a number of factors, including the following:

- 10 -

Approval of the Distribution Plan requires the affirmative vote of the holders of a “majority” (as defined in the Investment Company Act) of the outstanding voting securities of the Series. Such “majority” vote is defined as the vote of the holders of the lesser of (i) 67% or more of the voting securities present or represented by proxy at the shareholder meeting, if the holders of more than 50% of the outstanding voting securities are present or represented by proxy, or (ii) more than 50% of the outstanding voting securities. A vote in favor of this Proposal shall be deemed a vote to approve the proposed Distribution Plan.

THE BOARD RECOMMENDATION ON THE PROPOSAL

THE TRUSTEES UNANIMOUSLY RECOMMENDRECOMMENDS THAT

SHAREHOLDERS OF THE SERIES VOTE “FOR” THE

PROPOSAL

- 11 -

PROPOSAL.

Series C. As of September 3, 2015, Security Investors, LLC had approximately $27.4 billion in assets under management. Security Investors, LLC is an affiliate of SBL. opportunity to transfer their contract values currently allocated to Series C to other investment options available under their Contracts prior to the Liquidation Date. From the date of these proxy materials until at least 90 days after the Liquidation Date, transfers from the subaccount that invests in Series C will be free of charge and will not count as a transfer for purposes of any limit on the number of free transfers a Contract Owner may have during a period of time. INSTRUCTION CARD, UNLESS YOU LATER ELECT TO CHANGE YOUR OTHER BUSINESSThe Trustees do not know of any matters to be presented at the Meeting other than those set forth in this Proxy Statement. If other business should properly come before the Meeting, proxies will be voted in accordance with the judgment of the persons named in the accompanying proxy.Investment ManagerSecurity Investors, LLC, also known as Guggenheim Investments, (referred to herein as “Security Investors” or the “Investment Manager”), 805 King Farm Boulevard, Suite 600, Rockville, Maryland 20850, is the investment manager for the Series.Principal Underwriter/DistributorThe principal underwriter/distributor of the Series C is Guggenheim Funds Distributors, LLC (“Guggenheim Funds Distributors”), located at 805 King Farm Boulevard, Suite 600, Rockville, Maryland 20850. Guggenheim Funds Distributors is an affiliate of Guggenheim Partners, LLC (“Guggenheim Partners”), a diversified financial services firm.AdministratorRydex Fund Services, LLC, (“RFS”), an affiliate of Security Investors, LLC, serves as the administrator and transfer and dividend-paying agent for the Series.Other InformationProxy materials, reports and other information filed by the Series C can be inspected and copied at the Public Reference Facilities maintained by the SEC at 100 F Street, NE, Washington, DC 20549. The SEC maintains an Internet web site (at http://www.sec.gov), which also contains other information about Series C.Transfer Rights. Contract Owners will have the Series.If you do not transfer your contract value in Series C, if any, to another investment option by the Liquidation Date, or if you do not provide transfer instructions to SBL, upon the liquidation of Series C, SBL will transfer the liquidation proceeds related to your contract value in Series C to Invesco V.I. Money Market Fund (Series II) (which is anticipated to become the Invesco V.I. Government Money Market Fund on or after the Liquidation Date).Shortly after the proposed liquidation, SBL or its affiliates will send to each Contract Owner whose contract value was transferred to the subaccount investing in the Invesco V.I. Money Market Fund a notice (accompanied by a transfer request form and a postage pre-paid return envelope) explaining that their contract values have been transferred and requesting that they submit a transfer request14in the event that they do not want to remain invested in the Invesco V.I. Money Market Fund (which is anticipated to become the Invesco V.I. Government Money Market Fund on or after the Liquidation Date).Contract Owners will not incur any transfer fees or other charges under the Plan of Liquidation. The proposed liquidation of Series C will not in any way affect the rights of Contract Owners or the obligations of SBL or its affiliates under the Contracts.Tax Consequences. The proposed liquidation, as well as transfers of contract values in anticipation or subsequent to the proposed liquidation, is generally not expected to create a federal income tax liability for you in connection with your Contract.Share Ownership. As of December 31, 2015, the Trustees and officers of the Trust did not own in the aggregate 1% or more of the outstanding shares of Series C.As of the Record Date, Series C had [ ] shares outstanding and entitled to vote. As of the Record Date, the following shareholders owned of record or beneficially five percent or more of Series C:Name of Series Amount of Shares Owned Percentage of the Class Name and Address of the Beneficial Owner [ ] [ ] [ ] [ ] Voting InformationProxy Solicitation.The principal solicitation of proxies will be by the mailing of this Proxy Statement on or about [September March [14], 2014],2016, but proxies may also be solicited by telephone and/or in person by representatives of the Trust, regular employees of Guggenheim Investments or its affiliate(s), or [ ],AST Fund Solutions, LLC, a private proxy services firm. If we have not received your vote as the date of the Meeting approaches, you may receive a telephone call from these parties to ask for your vote. Arrangements will be made with brokerage houses and other custodians, nominees, and fiduciaries to forward proxies and proxy materials to their principals.Cost of the Solicitation.The cost of retaining [ ]AST Fund Solutions, LLC will be borne by the Investment Manager.Guggenheim Investments. The estimated cost of retaining [ ]AST Fund Solutions, LLC is approximately [$32,000]$[21,216].- 12 -Shareholder Voting. Shareholders of the Series C who own shares at the close of business on [August 22, 2014]the Record Date will be entitled to notice of, and to vote at, the Meeting. Each share is entitled to one vote and each fractional share is entitled to a fractional vote. The number of shares of each Series C as to which voting instructions may be given to the Trust is determined by dividing the amount of the shareholder’s insurance product accountcontract value attributable to a Series C on the Record Date by the net asset value per share of the Series C as of the same date.Information regarding the number of issued and outstanding shares of each Series as of the Record Date is provided in Appendix [B], representing the same number of votes for each of the Series. The Insurance Companies who are known to have owned beneficially 5% or more of each Series’ outstanding shares as of the Record Date are listed in Appendix [C].Insurance Companies that use shares of a Series as funding media for their insurance products will vote shares of the Series held by their separate accounts in accordance with the instructions received from owners of the insurance products. An Insurance Company also will vote shares of a Series held in the separate account for which it has not received timely instructions in the same proportion as it votes shares held by that separate account for which it has received instructions. An Insurance Company whose separate account invests in a Series will vote shares by its general account and its subsidiaries in the same proportion as other votes cast by its separate account in the aggregate. As a result, a small number of insurance product owners could determine the outcome of the vote if other owners fail to vote.More than thirty-threeThirty-three and one-third percent (33-1/3%) of a Series’Series C shares, represented in person or by proxy, will constitute a quorum for the Meeting and must be present for the transaction of business at the Meeting with respect to the Series.Series C. Only proxies that are voted, abstentions and “broker non-votes” will be counted toward establishing a quorum.quorum, but abstentions and “broker non-votes” will not be counted as Shares voted (votes cast) with respect to such proposal or proposals. “Broker non-votes” are shares held by a broker or nominee as to which instructions have not been received from the15beneficial owners or persons entitled to vote, and the broker or nominee does not have discretionary voting power.SBL and its affiliates, whose separate accounts invest in Series C, will vote any shares by its general account and its subsidiaries in the same proportion as other votes cast by its separate accounts in the aggregate. Because the Insurance Companies useSBL uses proportional voting, as explained above, the presence of such Insurance CompaniesSBL at the Special Meeting shall be sufficient to constitute a quorum for the transaction of business at the Special Meeting.In the event that sufficient votes to approve a Proposal are not received, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of a majority of a Series’ shares represented at the Meeting in person or by proxy (excluding abstentions and broker non-votes).The person(s) named as proxies on the enclosed voting instruction card will vote in accordance with your directions, if your proxy is received properly executed. If we receive your proxy, and it is executed properly, but you give no voting instructions with respect to any proposal, your shares will be voted “FOR”“FOR” the Proposal. The duly appointed proxies may, in their discretion, vote upon such other matters as may properly come before the Meeting.In order that your shares may be represented at the Meeting, you are requested to vote your shares by mail, Internet or telephone by following the enclosed instructions.IF YOU VOTE BY TELEPHONE OR INTERNET, PLEASE DO NOT RETURN YOUR VOTING- 13 -VOTE.VOTERequired Vote. Approval of the Liquidation Proposal requires the affirmative vote of the holders of a “majority”majority of the outstanding voting securitiesshares of the Series. Such “majority” vote is defined as the vote of the holders of the lesser of (i) 67% or more of the voting securities present or represented by proxy at the shareholder meeting, if the holders of more than 50% of the outstanding voting securities are present or represented by proxy, or (ii) more than 50% of the outstanding voting securities.Series C entitled to vote. Assuming the presence of a quorum, abstentions and broker non-votes have the effect of a negative vote.Shareholders Sharing the Same Address. As permitted by law, only one copy Approval of this Proxy Statement mayany other proposal would be delivered to shareholders residing at the same address, unless such shareholders have notified the Trust of their desire to receive multiple copies of the shareholder reports and proxy statements that the Trust sends. If you would like to receive an additional copy, please contact the Trust by writingsubject to the Trust’s address, or by calling the telephone number shown on the front page of this Proxy Statement. The Trust will then promptly deliver, upon request, a separate copy of this Proxy Statement to any shareholder residing at an address to which only one copy was mailed. Shareholders wishing to receive separate copies of the Trust’s shareholder reports and proxy statementsapplicable voting requirements as set forth in the future, and shareholders sharing an address that wish to receive a single copy if they are receiving multiple copies, should also send a request as indicated.Shareholder ProposalsAs a general matter, the Trust does not hold annual meetings of shareholders. Shareholders wishing to submit proposals for inclusion in a proxy statement for a subsequent shareholders’ meeting should send their written proposal to the Secretary of the Trust.Proposals must be received a reasonable time before the Trust begins to print and set the proxy materials in order to be considered for inclusion in the proxy materials for the meeting. Timely submission of a proposal does not, however, necessarily mean that the proposal will be included. Persons named as proxies for any subsequent shareholders’ meeting will vote in their discretion with respect to proposals submitted on an untimely basis.TO ENSURE THE PRESENCE OF A QUORUM AT THE SPECIAL MEETING, PROMPT EXECUTION AND RETURN OF THE ENCLOSED PROXY IS REQUESTED. A SELF-ADDRESSED, POSTAGE-PAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE, ALONG WITH INSTRUCTIONS ON HOW TO VOTE OVER THE16INTERNET OR BY TELEPHONE SHOULD YOU PREFER TO VOTE BY ONE OF THOSE METHODS.By Order of the Board of Trustees, Donald C. CacciapagliaPresident, Chief Executive Officer and Trustee

- 14 -

FORM OF PLAN

FORM OF DISTRIBUTION AND SHAREHOLDER SERVICES PLAN OF

I.The

II.Shares of the Series. It is understood that shares of beneficial interest (“Shares”) of each Series may be offered to life insurance companies for allocation to certain of their separate accounts established for the purpose of funding variable annuity contracts and/or variable life insurance policies (“Variable Contracts”) and may also be offered to certain other persons including qualified pension and retirement plans (“Qualified Plans”).

III.Distribution and Service Agreement. The Trust has entered into a Distribution Agreement with respect to each Series with Guggenheim Funds Distributors, LLC (“Guggenheim Funds Distributors”), under which Guggenheim Funds Distributors serves as the Series principal underwriter. This Plan does not require Guggenheim Funds Distributors to perform any specific type or level of distribution activities or to incur any specific level of expenses for activities primarily intended to result in the sale of Shares of any Series. Any distribution and service agreement (“Agreement”) relating to the implementation of this Plan shall be in writing and subject to approval and termination pursuant to the provisions of Sections 6 and 8 of this Plan. However, this Plan shall not obligate the Series or any other party to enter into such Agreement.

IV.Compensation.

A. Shares of each Series shall pay to Guggenheim Funds Distributors, as compensation for providing distribution, shareholder and administrative services, a fee at the rate specified for that Series on Schedule B, such fee to be calculated and accrued daily and paid monthly or at such other intervals as the Board shall determine.

B. The fees payable hereunder are payable without regard to the aggregate amount that may be paid over the years, PROVIDED THAT, so long as the limitations set forth in Rule 2830 of the Conduct Rules (“Rule 2830”) of the Financial Industry Regulatory Authority, Inc. (“FINRA”) remain in effect and apply to recipients of payments made under this Plan, the amounts paid hereunder shall not exceed those limitations, including permissible interest.

V.A.Distribution Services. As principal underwriter of the Trust’s shares, Guggenheim Funds Distributors may spend such amounts as it deems appropriate on any activities or expenses primarily intended to result in the sale of Shares of the Series, including, but not limited to, compensation to employees of Guggenheim Funds Distributors; compensation

to Guggenheim Funds Distributors and other broker-dealers that engage in or support the distribution of shares or variable contracts whose proceeds are invested in shares of the Series; expenses of Guggenheim Funds Distributors and such other broker-dealers and entities, including overhead and telephone and other communication expenses; the printing of prospectuses, statements of additional information, and reports for other than existing shareholders; and the preparation and distribution of sales literature and advertising materials.

B.Administration and Shareholder Services. Guggenheim Funds Distributors may spend such amounts as it deems appropriate on the administration and servicing of the Series’ shareholder accounts. Such expenditures may be for providing or obtaining services including, but not limited to, the following: administering periodic investment and periodic withdrawal programs; researching and providing historical account activity information for shareholders requesting it; preparing and mailing account and confirmation statements to account holders; preparing and mailing tax forms to account holders; serving as custodian to retirement plans investing in Shares; dealing appropriately with abandoned accounts; collating and reporting the number of Shares attributable to each state for blue sky registration and reporting purposes; identifying and reporting transactions exempt from blue sky registration requirements; and providing and maintaining ongoing shareholder services for the duration of the shareholders’ investment in Shares of each Series, which may include updates on performance, total return, other related statistical information, and a continual analysis of the suitability of the investment in Shares of each Series. Expenditures by Guggenheim Funds Distributors may also be for providing services to life insurance companies that issue the Variable Contracts, their affiliates, or current and prospective owners of Variable Contracts including, but not limited to, the following: teleservicing support in connection with the Series; delivery and responding to inquires respecting the Series’ Prospectus and/or Statement of Additional Information, reports, notices, proxies and proxy statements and other information respecting the Series (but not including services paid for by the Trust such as printing and mailing); facilitation of the tabulation of Variable Contract owners’ votes in the event of a meeting of Trust shareholders; conveyance of information to the Trust, or its transfer agent as may be reasonably requested; provision of support services including providing information about the Trust and the Series and answering questions concerning the Trust and the Series, including questions respecting Variable Contract owners’ interests in the Series; provision and administration of Variable Contract features for the benefit of Variable Contract owners participating in the Series including fund transfers, dollar cost averaging, asset allocation, portfolio rebalancing, earnings sweep, and pre-authorized deposits and withdrawals; and provision of other services deemed appropriate by Guggenheim Funds Distributors from time to time.

VI.Effectiveness and Continuation. This Plan shall take effectis intended to accomplish the complete liquidation and dissolution of the Fund and the redemption and cancellation of the Fund’s outstanding shares in conformity with respect tothe laws of the State of Delaware, the 1940 Act, the Internal Revenue Code of 1986, as amended (the “Code”), the Trust’s Declaration of Trust (the “Declaration of Trust”), and the Trust’s By-laws (the “By-laws”).

VII.Amendment. This Plan may be amendedterminated at any time by the Board of Trustees; and

VIII.Termination. This Plan may be terminated at any time with respect to a Series, without the payment of any penalty, by vote of a majority of the Independent Trustees or by a vote of a majority of the outstanding voting securities of the Shares of the Series.

IX.Reports. During the existence of this Plan, each Series shall require Guggenheim Funds Distributors to provide the Trust, for review byPlan; and

| 1. | Effective Date of Plan. This Plan shall become effective on April [ ], 2016 (the “Effective Date”). |

| 2. | Liquidation. Consistent with this Plan, and in accordance with the Declaration of Trust, By-laws, and all applicable laws and regulations, including but not limited to Section 331 of the Code, the Fund shall be liquidated and dissolved as promptly as practicable following the Effective Date and notice to shareholders of the Fund. |

| 3. | Cessation of Business. On the Effective Date or as soon as practicable thereafter, the Fund shall cease its business as a series of an investment company, may depart from its stated investment objective, strategies and policies as it prepares to distribute its assets to shareholders, and shall not engage in any business or activities, except for the purposes of: (a) winding up the Fund’s business and affairs; (b) marshalling and preserving the value of the Fund’s assets; and (c) distributing the Fund’s assets to shareholders in redemption of their shares in accordance with this Plan after making payment to (or making reasonable provision to pay) all creditors of the Fund, |

| 4. | Notice to Shareholders. As soon as practicable after the adoption of this Plan, the Trust shall provide notice to the Fund’s shareholders and other appropriate parties that this Plan has been approved by the Board of Trustees, and that the Fund will be liquidating its portfolio securities and other assets, redeeming its outstanding shares and distributing its remaining assets to shareholders. |

| 5. | Restriction on Sale of Shares. The Fund shall cease offering the sale of its shares as soon as practicable on or after the Effective Date. Any redemptions requested between the Effective Date and Liquidation Date (as defined below) may be made in cash or in-kind as provided in the Fund’s currently effective Registration Statement. |

| 6. | Liquidation of Assets. On or about [ ], 2016 (the “Liquidation Date”), all of the Fund’s portfolio securities and other assets shall be converted into cash, cash equivalents or other liquid assets. In the alternative, if determined to be in the best interests of the Fund and its shareholders, the Board of Trustees or the officers of the Trust may elect not to liquidate all or a portion of the Fund’s portfolio securities and other assets, and elect to distribute such portfolio securities and other assets in-kind or distribute a combination of cash and portfolio securities and other assets in-kind to shareholders in redemption of their shares consistent with applicable statutes and regulations, which shall constitute a “liquidating distribution” under Section 8 of this Plan. |

| 7. | Payment of Debts. As soon as practicable after the Effective Date, the Fund shall determine and pay, or make reasonable provision to pay, in full the amount of the Fund’s known (including known but for which the identity of the claimant is unknown), or unknown or not yet arisen but reasonably likely to become known or arise, claims and obligations, including all contingent, conditional or unmatured claims and obligations prior to the date of the liquidating distribution provided for in Section 8 of this Plan. |

| 8. | Liquidating Distribution. As soon as practicable after the Effective Date, and in any event on the Liquidation Date, the Fund shall distribute ratably according to the number of shares held by each shareholder of record of the Fund as of the close of business on the Liquidation Date a liquidating distribution (or distributions, if more than one distribution shall be necessary) comprising all of the remaining assets of the Fund, after paying or making reasonable provision to pay claims and obligations pursuant to Section 7 above, in complete cancellation and redemption of all the outstanding shares of the Fund, except for cash, bank deposits or cash equivalents in an estimated amount necessary to (i) discharge any unpaid claims and obligations of the Fund on the Fund’s books on the Liquidation Date, including but not limited to, income dividends and capital gains distributions, if any, payable through the Liquidation Date and (ii) pay such contingent claims and obligations as the Board shall reasonably deem to exist against the assets of the Fund on the Fund’s books. |

X.Limitation of Liability. Consistent with the limitations of liability as set forth in the Trust’s Declaration of Trust, any obligations assumed by a Series pursuant to this Plan and any agreements related to this Plan shall be limited in all cases to that Series and its assets, and shall not constitute obligations of any other series ofshareholder’s shares of the Trust,Fund held on the Liquidation Date, the Fund’s outstanding shares shall all be deemed cancelled.

| 9. | Satisfaction of Federal Income and Excise Tax Distribution Requirements. If necessary, the Fund shall, by the Liquidation Date, have declared and paid a dividend or dividends which, together with all previous such dividends, shall have the effect of distributing to the Fund’s shareholders all of the Fund’s investment company taxable income for the taxable years ending at or prior to the Liquidation Date (computed without regard to any deduction for dividends paid), and all of the Fund’s net capital gain, if any, realized in the taxable years ending at or prior to the Liquidation Date (computed without regard to any deduction for dividends paid, or after reduction for any available capital loss carry-forward, as appropriate), and undistributed net income from tax-exempt obligations and any additional amounts necessary to avoid any excise tax or income tax for such periods. Such dividends may be paid either prior to or at the same time as the liquidating distribution. |

| 10. | Management and Expenses of the Fund.The Investment Manager shall bear expenses incurred in carrying out this Plan, including printing, legal, accounting, custodian and transfer agency fees, and the expenses of notices to shareholders, whether or not the liquidation contemplated by this Plan is effected, provided that such accrued amounts are first applied to pay for the Fund’s normal and customary fees and expenses. Any expenses and liabilities attributed to the Fund subsequent to the distribution of the liquidating distribution shall be borne by the Investment Manager, which shall continue through the Liquidation Date any undertaking to limit Fund operating expenses at the levels in effect as of the adoption of this Plan by the Board of Trustees. |

| 11. | Receipt of Cash or Other Distributions After the Liquidation Date.Following the Liquidation Date, if the Trust, on behalf of the Fund, receives any form of cash or is entitled to any other distributions that it had not previously recorded on its books, such cash or other distribution shall be disbursed to each shareholder of record on the Liquidation Date ratably according to the number of shares held by the shareholder on the Liquidation Date; provided, however, that the Fund shall not be required to disburse to its shareholders of record on the Liquidation Date any cash or other distribution that the Treasurer or similar officer of the Trust determines to be de minimis after taking into account all expenses associated with effecting the disposition thereof. Any cash or other distribution received by the Trust, on behalf of the Fund, and determined to be de minimis shall be, at the discretion of the Treasurer or similar officer of the Trust and, to the extent consistent with applicable law, rule or regulation, either: (i) distributed proportionately among the remaining series of |

| 12. | Power of the Board of Trustees and Delegation of Authority to the Trust’s Officers. The Board of Trustees, and subject to the authority of the Board of Trustees, the Trust’s officers, shall have authority to perform or authorize any actions provided for in this Plan, and any further actions as they may consider necessary or desirable to carry out the purposes of this Plan, including the execution and filing of all certificates, documents, information returns, tax returns and other papers that may be necessary or appropriate to implement this Plan, or that may be required by the 1940 Act, the Code, the laws of the State of Delaware, or any other applicable law or regulation. The officers of the Trust, collectively or individually, may modify or extend any of the dates specified in this Plan for the taking of any action in connection with the implementation of the Plan (including, but not limited to, the Effective Date and the Liquidation Date) if such officer(s) determine, with the advice of counsel, that such modification or extension is necessary or appropriate in connection with the orderly liquidation of the Fund or to protect the interests of the shareholders of the Fund. |

| 13. | Amendment or Abandonment of Plan. The Board of Trustees may authorize and/or ratify variations from or amendments to this Plan as may be necessary or appropriate to effect the liquidation and dissolution of the Fund and the distribution of the Fund’s net assets to its shareholders in redemption of the Fund’s outstanding shares in accordance with the laws of the State of Delaware, the 1940 Act, the Code, the Declaration of Trust, and the By-laws, if the Board of Trustees determines that such action would be advisable and in the best interests of the Fund and its shareholders. The Board of Trustees may abandon this Plan at any time if it determines that abandonment would be advisable and in the best interests of the Fund and its shareholders. |

| 14. | Filings with Regulatory Authorities. The Board of Trustees hereby authorizes and directs the Trust’s officers and other appropriate parties to file all certificates, documents, information returns, tax returns, forms, and other papers that may be necessary or appropriate to implement this Plan or that may be required by the laws of the State of Delaware, the Declaration of Trust and By-laws of the Trust, the Code, any applicable securities laws, and any rules and regulations of the U.S. Securities and Exchange Commission, any state securities commission and such other authorities as may be deemed necessary or appropriate to carry out the intent of this Plan. |

| 15. | Governing Law. This Plan shall be subject to and construed consistently with the Declaration of Trust and By-laws and otherwise shall be governed by and in accordance with the laws of the State of Delaware. |

| 16. | Trust Only. The obligations of the Trust entered into in the name or on behalf thereof by any of the Trustees of the Trust, representatives or agents of the Trust are made not individually, but only in such capacities, and are not binding upon any of the Trustees of the Trust, shareholders or representatives of the Trust personally, but bind only the assets of the Trust. |

XI.Non-Interested Trustees. So long as the Plan is in effect, the selection and nomination of those Trustees who are not interested persons (as defined in the 1940 Act)undersigned, duly authorized officers of the Trust shall be committed toand the discretionInvestment Manager have executed this document as of the non-interested Trustees then in office.

XII.Miscellaneous. If any provision[ ] day of this Plan shall be held or made invalid by a court decision, statute, rule or otherwise, the remainder of the Plan shall not be affected thereby.

DISTRIBUTION AND SHAREHOLDER SERVICES PLAN

OF GUGGENHEIM VARIABLE FUNDS TRUST

SCHEDULE A

| ||||

| ||||

| ||||

DATED: [ ]

PLAN PURSUANT TO 12B-1

OF GUGGENHEIM VARIABLE FUNDS TRUST

SCHEDULE B

| ||||

DATED: [ ]

APPENDIX B

OUTSTANDING SHARES

As of the Record Date, the total number of shares outstanding for each], 2016.

| ||

| ||

|

C (Money Market Series

BENEFICIAL OWNERS OF MORE THAN 5% OF EACH SERIES

As of the Record Date, the Trustees and Officers as a group owned less than 1% of the outstanding shares of either Series. As of the Record Date, the following persons owned, of record and beneficially (unless otherwise indicated), 5% or more of a class of a Series’ outstanding securities:

| ||||||

| ||||||

|

[FORM OF VOTING INSTRUCTION CARD]

GUGGENHEIM VARIABLE FUNDS TRUST

805 King Farm Boulevard, Suite 600

Rockville, Maryland 20850

(Toll-Free) [1-800-820-0888]

(MONEY MARKET SERIES)

[October 10] TO BE HELD ON APRIL [15], 2014

2016

|

| SERIES C (MONEY MARKET SERIES) | PROXY CARD | ||||

YOUR SIGNATURE IS REQUIRED FOR YOUR VOTE TO BE COUNTED.Please sign exactly as your name appears on this Proxy. If joint owners, EITHER may sign this Proxy. When signing as attorney, executor, administrator, trustee, guardian or corporate officer, please give your full title. | |||||

SIGNATURE (AND TITLE IF APPLICABLE) DATE | |||||

SIGNATURE (IF HELD JOINTLY) DATE | |||||

Please vote, date and sign this voting instruction card and return it promptly in In his/her discretion, the enclosed envelope. Please indicate your vote by an “x” in the appropriate box below.

Proxy Voting Instructions

The Series encourage all shareholdersis authorized to vote their proxies. We now provideupon such other matters as may properly come before the following convenient methods of voting: 1) VOTING INSTRUCTION CARD: Complete, sign, date and return the voting instruction card attached below in the enclosed postage-paid envelope; or instead vote by 2) TELEPHONE or 3) INTERNET by following the enclosed instructions. If you choose to vote by telephone or via the Internet, do not return your voting instruction card unless you later decide to change your vote.

Meeting

| FOR | AGAINST | ABSTAIN | |||||

| 1. To Approve a Plan of Liquidation with Regard to Series C (Money Market Series). | ¢ | ¢ | |||||

| SERIES C (MONEY MARKET SERIES) | |

| VOTING INFORMATION FORM | |

YOUR SIGNATURE IS REQUIRED FOR YOUR VOTE TO BE COUNTED.Please sign exactly as your name appears on this Proxy. If joint owners, EITHER may sign this Proxy. When signing as attorney, executor, administrator, trustee, guardian or corporate officer, please give your full title. | |

SIGNATURE (AND TITLE IF APPLICABLE) DATE | |

SIGNATURE (IF HELD JOINTLY) DATE | |

| FOR | AGAINST | ABSTAIN | ||||||

| 1. To Approve a Plan of Liquidation with Regard to Series C (Money Market Series). | ¢ | |||||||